Table of Contents

- Utilities Want to Change Solar Incentives - YouTube

- How to Make Solar Incentives Work For You - Exact Solar

- Solar Panels on Your Home & in Your Community - ppt download

- The Solar Panel Incentives You Need to Know About - The Better Web Movement

- Solar Incentives - Definition | Solar Terms | Sunrun

- Interpreting Your Solar Proposal - Northwest Electric & Solar

- Why 2023 Is The Best Time To Install Solar | Halcol Energy

- 2024 Government Solar Incentives - Tiff Shandra

- Solar Incentives For Your Business SRECS

- Solar Incentives | Sun Coast Roofing & Solar | Florida's Premier Re ...

Introduction to Solar Incentives

Solar Incentives by State

Federal Solar Incentives

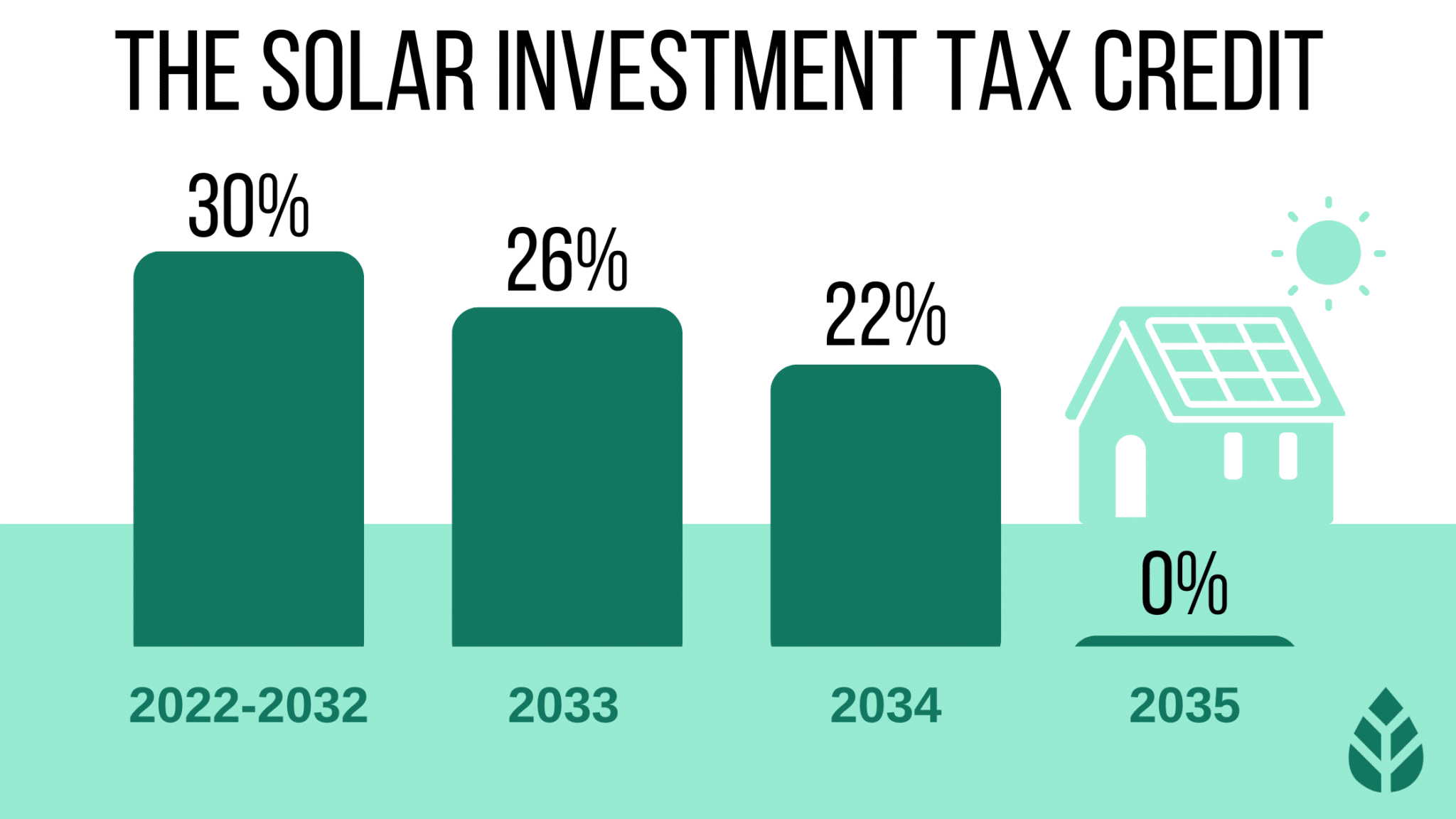

In addition to state-specific incentives, there are also federal solar incentives available to homeowners and businesses. The most notable federal incentive is the Solar Investment Tax Credit (ITC), which allows homeowners and businesses to claim a tax credit of up to 26% of the total cost of solar panel installation. Solar incentives by state can vary significantly, but with the help of ConsumerAffairs, you can navigate the landscape and find the best incentives for your needs. Whether you're a homeowner or business owner, there are numerous programs available to help you save money on solar panel installation. By taking advantage of these incentives, you can reduce your energy bills, increase your property value, and contribute to a more sustainable future. So why wait? Start exploring the solar incentives in your state today and join the thousands of Americans who have already made the switch to solar energy.For more information on solar incentives by state, visit ConsumerAffairs and start saving on your solar panel installation today!

Note: The article is written in HTML format with header tags (h1, h2) and paragraphs (p) to make it SEO-friendly. The article also includes internal and external links to relevant sources, such as ConsumerAffairs and the IRS website. The word count is approximately 500 words.